what is my paypal link to receive money

It's difficult to imagine what life was like for freelancers and entrepreneurs earlier online payment processing came along. Of these services, none is more pop than PayPal. However, many freelancers and entrepreneurs are less than thrilled about paying numerous PayPal fees for receiving money from clients.

Information technology's truthful that paying out a percentage of your income to get your coin in the first identify is a hurting. You might even be tempted to ditch PayPal altogether for something with fewer fees.

Simply in that location'due south a reason PayPal reigns supreme in the world of online payment processing.

After all, zilch is quite every bit convenient as a web-based payment portal that links direct to your banking concern account. Plus, when it comes fourth dimension to request payment from a customer, you want to offering them a payment method they already recognize and trust.

So are you doomed to pay out every time a client settles their invoice through PayPal? To an extent, yeah.

But there are also several ways to decrease your PayPal fees for receiving coin. You only need to know what to practice.

What Is PayPal?

After over 20 years in business, PayPal and e-commerce pretty much get hand-in-paw. In fact, it's hard to call back a time when you couldn't but click a push button and ship money to a friend, family fellow member, or merchant.

Instead of giving your bank account information directly to a company or private, PayPal acts as a secure 3rd-party. Not just does this mean your fiscal information stays individual, but it also ways y'all have support if something goes wrong with the transaction.

Since PayPal has been effectually for and so long, many people take this service for granted. Merely as a freelancer or entrepreneur, your life would exist a whole lot more difficult without this payment processing service.

Unfortunately, this convenient service too comes with some fees:

PayPal fee structure

Of course, PayPal doesn't operate out of the goodness of its heart. To stay in business organisation, the company needs to brand some form of income off of its services.

To practise this, PayPal charges a fee for virtually transactions that become through its system. And in most cases, these fees are charged to the person or company receiving the money.

So how much should you expect to pay each time you receive money through PayPal?

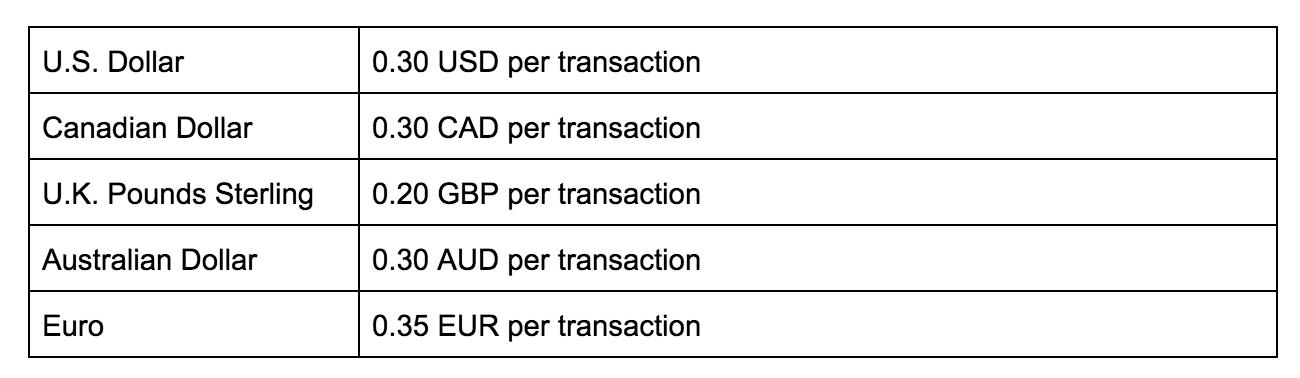

To beginning, PayPal applies a fixed-charge per unit fee to each applicable transaction. This fee will vary depending on the transaction'south currency.

Some of the near pop currencies and their corresponding fees include:

On pinnacle of this fixed-charge per unit fee, PayPal also charges a percentage of each transaction's total. This percentage will vary depending on the location of your and your client'southward bank accounts. Online transactions are as well subject to higher fees than in-person transactions.

Assuming that you're located inside the U.Southward. and are accepting online payments, your fee percentage would exist:

- ii.9% if your client's bank business relationship is within the U.South.

- 4.4% if your client's bank business relationship is outside the U.S.

As you tin can meet, these variable fees take out a far larger clamper of your income than the fixed fees applied to each transaction.

Why Freelancers and Entrepreneurs Should Accept PayPal

If you're new to freelancing or entrepreneurship, online payments might exist the merely method you know. But before PayPal and services like invoicely, creating, sending, and settling piece of work invoices was a much different experience.

At first, you might look at the fees PayPal takes from your incoming payments and feel discouraged or even cheated. However, many benefits come along with these fees:

- Your clients tin can make (almost) instant payments

- Your clients don't need an existing PayPal business relationship to brand payments

- You tin ready upward an account for yourself within minutes

- PayPal charges less than many other payment services

No payment processing service is 100 percent perfect. But when information technology comes to offering a quick and easy-to-use system for your clients, PayPal is one of the best options effectually.

v Ways to Avert or Subtract Your PayPal Fees for Receiving Coin

Charging fees to receive payment isn't unique to PayPal.

Even brick-and-mortar retailers that take credit cards have to pay a percent to Visa, Mastercard, American Express, and others each fourth dimension a customer uses ane of these cards. Simply as a modest freelancer or entrepreneur, these fees tin feel like a major hitting to your income.

Fortunately, there are several means to cutting down on PayPal fees. Here are merely a few of these methods, likewise as why you should or should non utilize them:

1. List PayPal fees as a billable expense

Perhaps the all-time style to offset PayPal fees for receiving money is by passing them on as a billable expense.

Whether you operate every bit a freelancer or small business, billable expenses are costs you lot contractually laissez passer on to the customer (commonly by including them in the final invoice). Essentially, your customer would pay the transaction fees instead of you.

For example:

Your customer'south final full due is $1,300. If the customer is submitting an online payment from within the U.S. (and is, therefore, subject to PayPal's standard fees of $.xxx + 2.ix%), y'all would instead invoice them for $i,338. In one case PayPal charges the applicative fees, yous would be left with the original full due of $one,300.

While you need to include these expenses in your contract and let the client know what will be charged, this is a completely feasible method for avoiding PayPal fees.

two. Receive fewer payments

This method is effective, merely only to an extent.

By receiving fewer payments in the first identify, you can avoid paying the stock-still-charge per unit fee every time. All the same, since each payment is nevertheless subject to the per centum-based fee, you won't save very much this way.

If you lot're someone who believes every cent counts, though, this method volition technically assistance avoid some of PayPal'south fees.

3. Request clients pay you every bit a friend

We're going to list this method here considering it'southward a fairly mutual way freelancers and small businesses avoid paying boosted PayPal fees. Withal, that doesn't mean we condone this way of evading fees.

When someone, including a customer, uses PayPal to ship a payment straight, they accept the pick to label a transaction as personal or business-related. Unlike business-related payments, personal transactions aren't subject to boosted fees.

Once again, this method of avoiding PayPal's fees might piece of work in the brusk-term. But if y'all are caught using this method, PayPal is likely to end your account completely.

In other words, delight don't endeavour this method.

4. List PayPal fees as a business expense

We mentioned how yous can pass on PayPal fees to your clients as a billable expense. Withal, you tin can also list them equally a business expense on your taxes.

Business expenses permit you to deduct certain costs from your annual income. This might not seem like much at offset, but tracking these expenses throughout the year tin significantly lower your taxes owed.

If you choose to reduce your PayPal fees for receiving money this style, brand certain you continue records of your PayPal transactions and the fees charged. You'll need to this information is y'all e'er undergo an audit.

v. Choose the right withdrawal method

Receiving money through PayPal means paying a few fees. Just and then does withdrawing that money.

While this method doesn't deal specifically with reducing your fees for receiving money in the start place, it's still useful data — especially if yous rely on PayPal for all or almost of your income.

Generally, there are two ways to motion coin from your PayPal residual to your checking or savings account:

Showtime, yous can transfer your chosen amount direct to a debit card. This transfer takes only a few seconds to complete. However, y'all'll exist charged 1 percentage — but no more than $10 — for doing so.

2nd, you can transfer money from your PayPal residuum to your checking or savings account. This transfer can have a few days to complete. However, there is no fee for doing and then.

If you employ PayPal with any regularity, planning ahead can assist salvage you quite a scrap of greenbacks.

Streamline Your Incoming Client Payments

Together with PayPal, invoicely offers a hassle-costless, reliable way for clients to pay yous for products or services. And when you take a whole business organization to run, easy is a necessity.

However, invoicely doesn't only help you create pro-quality invoices. It also lets y'all include a direct PayPal link in each of your invoices, making your client's lives only that much easier.

Plus, fifty-fifty your clients who don't already have a PayPal account can quickly and seamlessly settle their invoices through this link. All they demand to do is enter their payment information and click a button.

Learn more about incorporating PayPal into your client payment system with invoicely.

crothersnuied1997.blogspot.com

Source: https://blog.invoicely.com/paypal-fees-for-receiving-money/

0 Response to "what is my paypal link to receive money"

Postar um comentário